Protect Your Dreams

We are Perspective Shifters

We are Truth Tellers

We are Game Changers

Dream Protection

Life insurance has always played a vital role in society and it dates back almost 5,000 years. Ancient Egypt created a system called 'burial clubs' where individuals pooled their resources to provide proper burial arrangements for those that have died and their surviving family. There was a flat fee for this service with no other requirements. Burial clubs set the foundation for the development of modern-day life insurance practices.

Life insurance has evolved over time to offer different options to policyholders depending on their specific needs. Two common types are term insurance and permanent life insurance.

TERM LIFE INSURANCE

Term life insurance provides temporary coverage on an individual for a duration of time ranging from 10-30 years. The policy pays out a death benefit only if the insured passes away during the term duration selected. When the term expires, the policy is closed. It's a little like car insurance, necessary and provides peace of mind. When you need it you sure are happy you have it.

Term life insurance does not accumulate cash; however, most carriers offer living benefits that give the option to accelerate the death benefit in the event of an illness that is chronic, critical, terminal, or a critical injury.

Term life insurance typically has lower premiums and is easier to get approved. Most carriers have eliminated exams for individuals who are in decent health. We work with Ethos which is 100% online approval process. Ready to get covered?

DIFFERENT TYPES OF TERM LIFE INSURANCE

Renewable:

A policy that lets you renew your coverage without filling out a new application or needing a medical exam. Some insurers offer yearly renewable term policies.

Level:

A policy that has the same premium and death benefit for the life of the term.

Increasing or decreasing:

Throughout the term, the policy’s payout will either continually get larger or smaller. Premiums

usually rise with an increasing term policy but may not change with a decreasing term.

Convertible:

A policy that allows you to switch to permanent life insurance within a certain number of years. Like with term

renewability, you don’t need to requalify.

Guaranteed issue:

Usually involving a waiting period and higher premiums, this type of policy doesn’t require a medical exam or health questionnaire for approval.

Return of premium:

This policy returns a portion of your premiums to you if the policy expires before you die.

Common times to purchase life insurance include:

When you buy a home

When you get married

When you have children

When you start a business

These events signify a major life event and that means it's time to sit down and restructure your life.

PERMANENT LIFE INSURANCE

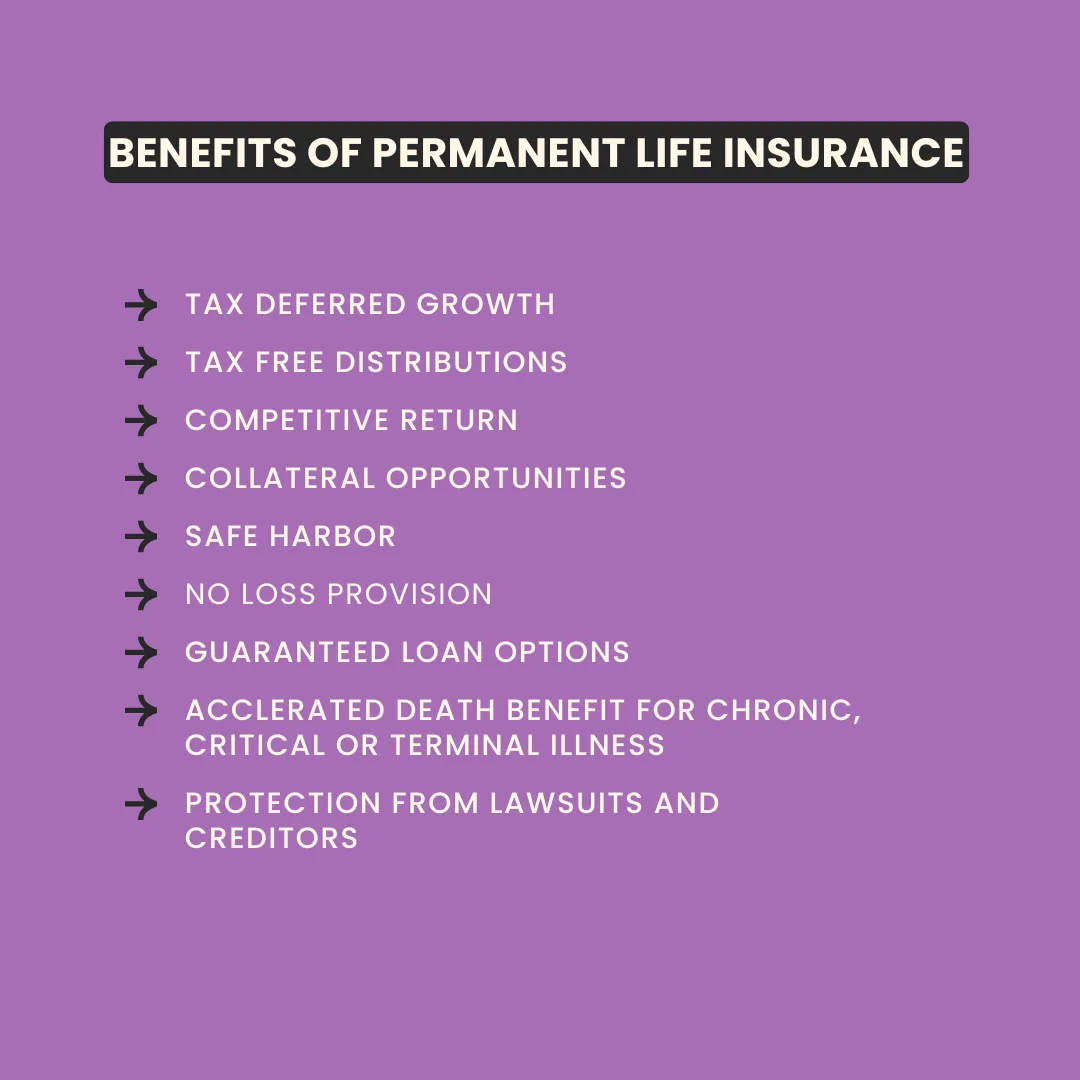

Permanent life insurance provides coverage for the full lifetime of the insured person. While permanent life is more expensive than term insurance, permanent policies combine a death benefit with a savings component that earns interest on a tax-deferred basis.

The primary types of permanent life insurance are whole life, universal life and indexed universal life. The cash value of permanent life insurance grows at a guaranteed rate. Indexed universal life insurance also contains savings and a death benefit, but it features more flexible premium options and its earnings are based on the performance of the selected indices (ex. S&P 500).

Here at Re'nita LaRae Financial we look at permanent life insurance as high yield savings account, but not an investment. The IRS does not consider permanent life insurance to be an asset, so the cash grows tax free and it's non-taxable upon withdrawal.

Check out our infinite banking strategy.

FAQS

Is there an exam for life insurance?

Most carriers try to stay away from an exam. It depends on what’s on your driver’s report, credit report, prescription history and medical information bureau report. They also consider your age, height/weight, occupation, tobacco use, if you engage in any risky activities and family health history.

How much life insurance do I need?

a. 30 times your income at ages 18 to 40

b. One-half of your net worth at ages 71 to 75

c. Amount of your mortgage or asset you’re looking to protect

How do I choose between term and permanent life insurance?

i. Duration - how long you feel you need life insurance coverage.

ii. Budget – how much can you afford monthly or annually.

iii. Financial Goals – are you looking to cover debts or income replacement, or are you looking for it to serve as a financial asset, providing cash value that you can borrow against or withdraw.

iv. Health - Consider your health and potential changes in the future. If you anticipate health issues that could affect insurability, permanent insurance may be a better long-term solution.

v. Flexibility – do you want something simple and straightforward with limited options for changes, or something more flexible, with options to adjust premiums, death benefits, and investment allocations.

How do I choose a beneficiary?

You have what they call ‘insured interest’ in the beneficiary. So someone who you care for or relies on you financially. A business you own or are a ‘key employee’ at.

A trust is highly suggested because:

b. Avoid probate

c. Simplify and speed up the distribution of your assets.

d. Provide greater flexibility and control through specific instructions on not only who receives your assets but also how (e.g., spread out over time, at the discretion of someone else, etc.).

e. Minimize conflict, as trust instructions cannot be contested in court like wills can.

f. Maintain privacy by keeping your assets from becoming public record as part of the probate process. g. Protect assets from creditors and lawsuits.

h. Minimize taxes, as certain types of trusts can reduce estate, gift or income taxes.

What if I have medical concerns?

If you have medical concerns find an 'independent' insurance agent, meaning they can sell insurance with various insurance carriers. That way they can shop around and see if there's a carrier that will work with your specific needs.

TESTIMONIALS

Client

Casandra Williams

Re'nita has been an asset to my businesses and for my families future. She truly cares about my goals and needs.

As an entrepreneur my biggest concern is retirement. She presented a few options that fit all my needs; with her expertise we decided on the financial plan that gave me the security I needed.

She even included my disabled parent to my long term financial planning. She has an amazing team! Everything was presented to me in a timely manner with check ins along the way.

Now I can focus on continuing to build my portfolio. Thank you Re’nita!

Julie Braun

Re'nita is someone who automatically brings out the best in others. She has a disarming calm and real approach which made me - from the first time I met her - felt safe. I think the thing that is most fascinating about Re'nita is her purpose driven passion. It is infectious and I look forward to more collaborations with her in the near future!

If you are considering working with her - do it and hurry! Get her before someone else snatches her up.

Deborah Orlandini

Re'nita LaRae Financial was a perfect fit for me and my investment portfolio needs. I have worked with multiple financial advisors and always felt that they didn’t have my best intention at heart.

I started working with Re'nita LaRae and found myself feeling confident that she was looking at a product that completely fitted my needs and wants for the current needs and the future goals. As a woman it’s important to feel that you have been heard and respected with these kind of transactions.

She did both.

The product she set me up with is proven to be successful in the desire of what I was looking to accomplish. I highly recommend her as your financial advisor.

Facebook

X

Youtube